Sending money across borders has never been easier than with Taptap Send. With its revolutionary instant remittance platform, Tap tap Send is changing the game for individuals and businesses alike. Say goodbye to exorbitant fees and long waiting times; Taptap Send allows you to transfer money instantly, right at your fingertips.

Whether you are sending money to support your family back home or paying international suppliers, Tap tap Send ensures a hassle-free experience. Its user-friendly interface and robust security features provide peace of mind, while its competitive exchange rates make sure you get the most bang for your buck.

With Taptap Send, you can send money from your mobile device or computer, anytime and anywhere. Say hello to convenience and wave goodbye to the complexities of traditional remittance methods. Unlock the power of instant remittances with Tap tap Send and experience a new level of financial freedom.

Join the thousands of satisfied customers who have already benefited from Taptap Send’s cutting-edge technology. Discover how this innovative platform is revolutionizing the way we send money globally. Get started today and see the difference for yourself.

In today’s increasingly globalized world, the need for seamless and efficient cross-border money transfers has never been more crucial. As people move across borders for work, education, or to support their families back home, the ability to send and receive money instantly has become a vital component of modern life. Traditional remittance methods, however, have often been plagued by exorbitant fees, lengthy processing times, and inconvenient access points, leaving many individuals and businesses frustrated and underserved.

The rise of digital remittance platforms, such as Taptap Send, has revolutionized the way we think about cross-border money transfers. Instant remittances have become a game-changer, empowering individuals and businesses to move money quickly, securely, and cost-effectively, regardless of their location. This shift has had a profound impact, particularly in developing countries where access to financial services has historically been limited or inaccessible.

Instant remittances have the power to transform lives, enabling families to receive critical financial support in a timely manner, small businesses to make timely payments to international suppliers, and individuals to manage their finances with greater flexibility and control. By eliminating the delays and high costs associated with traditional remittance methods, instant remittances have become a vital tool for fostering financial inclusion, supporting economic development, and strengthening global connections.

Taptap Send is a pioneering instant remittance platform that has been designed with simplicity and user-friendliness in mind. At its core, Taptap Send leverages advanced financial technology to facilitate lightning-fast cross-border money transfers, all from the convenience of your mobile device or computer.

The process of using Tap tap Send is remarkably straightforward. Users begin by downloading the Taptap Send mobile app or accessing the platform through their web browser. They then create an account, which involves providing basic personal information and verifying their identity. Once the account is set up, users can easily add their payment method of choice, whether it’s a bank account, debit card, or e-wallet.

The real magic happens when it’s time to send money to the Philippines. Users simply need to enter the recipient’s details, such as their name and mobile number or bank account information, along with the amount they wish to transfer. Taptap Send‘s cutting-edge technology then processes the transaction in real-time, ensuring that the funds are delivered instantly to the recipient’s preferred destination.

What sets Taptap Send apart is its commitment to transparency and competitive exchange rates. Users are provided with upfront information about the fees associated with their transfer, as well as the current exchange rate, allowing them to make informed decisions and ensure that their money goes as far as possible. This level of clarity and control is a refreshing departure from the often opaque and costly practices of traditional remittance providers.

Taptap Send’s instant remittance platform offers a wealth of benefits that make it an attractive choice for individuals and businesses alike. One of the most significant advantages is the speed of the transactions. With Tap tap Send, users can send money across borders in a matter of seconds, eliminating the lengthy wait times that are often associated with traditional remittance methods.

This instantaneous delivery of funds is particularly valuable for those who rely on timely financial support, such as families in developing countries or small businesses with international suppliers. No longer do they have to worry about delays that can disrupt their financial planning and cause unnecessary stress. Taptap Send‘s instant remittances provide peace of mind and allow recipients to access the funds they need when they need them most.

Another key benefit of using Taptap Send is the cost-effectiveness of the service. By leveraging cutting-edge financial technology and streamlining the remittance process, Taptap Send is able to offer competitive exchange rates and significantly lower fees compared to traditional remittance providers. This translates to more of the sender’s money reaching the intended recipient, ensuring that every transfer is maximized for the greatest impact.

Convenience is another hallmark of the Taptap Send experience. Users can initiate and complete remittance transactions from the comfort of their own homes or on-the-go, using their mobile devices or computers. This flexibility eliminates the need to visit physical remittance locations, which can be time-consuming and often inconvenient, particularly for those with busy schedules or limited access to transportation.

When compared to traditional remittance methods, Taptap Send’s instant remittance platform stands out as a superior choice in several key areas. One of the most significant differences is the speed of the transactions. While traditional remittance providers can take days or even weeks to process and deliver funds, Tapt ap Send’s instant remittances are completed in a matter of seconds, enabling recipients to access the money they need without delay.

Another area where Taptap Send shines is in terms of cost-effectiveness. Traditional remittance providers often charge exorbitant fees, which can eat into a significant portion of the transferred funds. Taptap Send, on the other hand, offers highly competitive exchange rates and lower fees, ensuring that more of the sender’s money reaches the intended recipient.

Convenience is another factor where Taptap Send outshines traditional remittance methods. With Taptap Send, users can initiate and complete remittance transactions from the comfort of their own homes or on-the-go, using their mobile devices or computers. This eliminates the need to visit physical remittance locations, which can be time-consuming and often inconvenient, particularly for those with busy schedules or limited access to transportation.

Traditional remittance providers also tend to have limited operating hours and a more restricted network of physical locations, which can further hinder the remittance process. Taptap Send’s digital platform, on the other hand, is accessible 24/7, allowing users to send money whenever it’s most convenient for them.

At Taptap Send, the security and protection of user data and financial transactions are of the utmost importance. The platform has implemented a robust set of security measures and safeguards to ensure the safety and integrity of every remittance transaction.

One of the key security features of Taptap Send is its commitment to compliance with industry-leading regulations and standards. The platform is fully compliant with all relevant anti-money laundering (AML) and know-your-customer (KYC) protocols, ensuring that every user is properly identified and verified before they can initiate a transaction.

Taptap Send also employs advanced encryption technologies to protect sensitive user information and financial data. All transactions are secured using the latest SSL/TLS protocols, which encrypt the data in transit and prevent unauthorized access or interception. Additionally, the platform’s servers are housed in secure, state-of-the-art data centers, further safeguarding the integrity of the system.

To enhance the security of its platform, Taptap Send has also implemented multi-factor authentication (MFA) for all user accounts. This means that in addition to a username and password, users must provide an additional form of verification, such as a one-time code sent to their registered mobile number or a biometric identifier like a fingerprint or facial recognition. This added layer of security helps to prevent unauthorized access and protect against fraudulent activities.

Taptap Send‘s commitment to security extends beyond its technical safeguards. The platform also has a dedicated team of security experts who continuously monitor the system for any potential threats or vulnerabilities, and they work tirelessly to implement the latest security updates and patches to ensure the ongoing protection of user data and funds.

Getting started with Tap tap Send is a straightforward and user-friendly process that can be completed in just a few simple steps. The first step is to download the Taptap Send mobile app, which is available for both iOS and Android devices. Alternatively, users can access the Taptap Send platform through the company’s website, which offers a seamless web-based experience.

Once the app or website is accessed, users will be prompted to create a Taptap Send account. This involves providing basic personal information, such as their name, email address, and phone number, as well as verifying their identity through a simple ID verification process. This step is essential to comply with regulatory requirements and ensure the security of the platform.

After the account is set up, users can proceed to add their preferred payment method, which can include a bank account, debit card, or e-wallet. Taptap Send supports a wide range of payment options, ensuring that users can choose the method that best suits their needs and preferences.

With the account and payment method in place, users can then begin sending money to their desired recipients. The process is straightforward – simply enter the recipient’s details, such as their name, mobile number, or bank account information, along with the amount you wish to transfer. Taptap Send’s instant remittance technology will then process the transaction in real-time, delivering the funds to the recipient’s preferred destination.

Throughout the entire process, Taptap Send provides users with transparent information about the fees and exchange rates associated with their transfers, ensuring that they can make informed decisions and maximize the value of their remittances. The platform also offers a range of helpful resources, including a user guide and customer support, to ensure a seamless and hassle-free experience for all users.

Taptap Send’s instant remittance platform has already garnered a loyal following of satisfied customers, each with their own unique story of how the service has positively impacted their lives or businesses. One such story comes from Maria, a domestic worker living in Dubai who regularly sends money to her family in the Philippines.

👉 “Before I discovered Taptap Send, sending money back home was always a hassle. I had to go to the local remittance center, wait in long lines, and pay exorbitant fees just to get my money to my family. With Taptap Send, everything has changed. I can now send money instantly, right from my phone, and the fees are so much lower. My family back home gets the full amount I send, and they receive it within seconds. It’s been a game-changer for us.”

Another success story comes from John, a small business owner who relies on Taptap Send to make timely payments to his international suppliers. 👉 “As a small business, every penny counts, and the high fees charged by traditional remittance providers were really cutting into our bottom line. With Taptap Send, we’re able to save a significant amount on each transaction, which has allowed us to reinvest that money back into our business and grow. The instant delivery of funds is also a huge advantage, as it helps us maintain strong relationships with our suppliers and ensure that our operations run smoothly.”

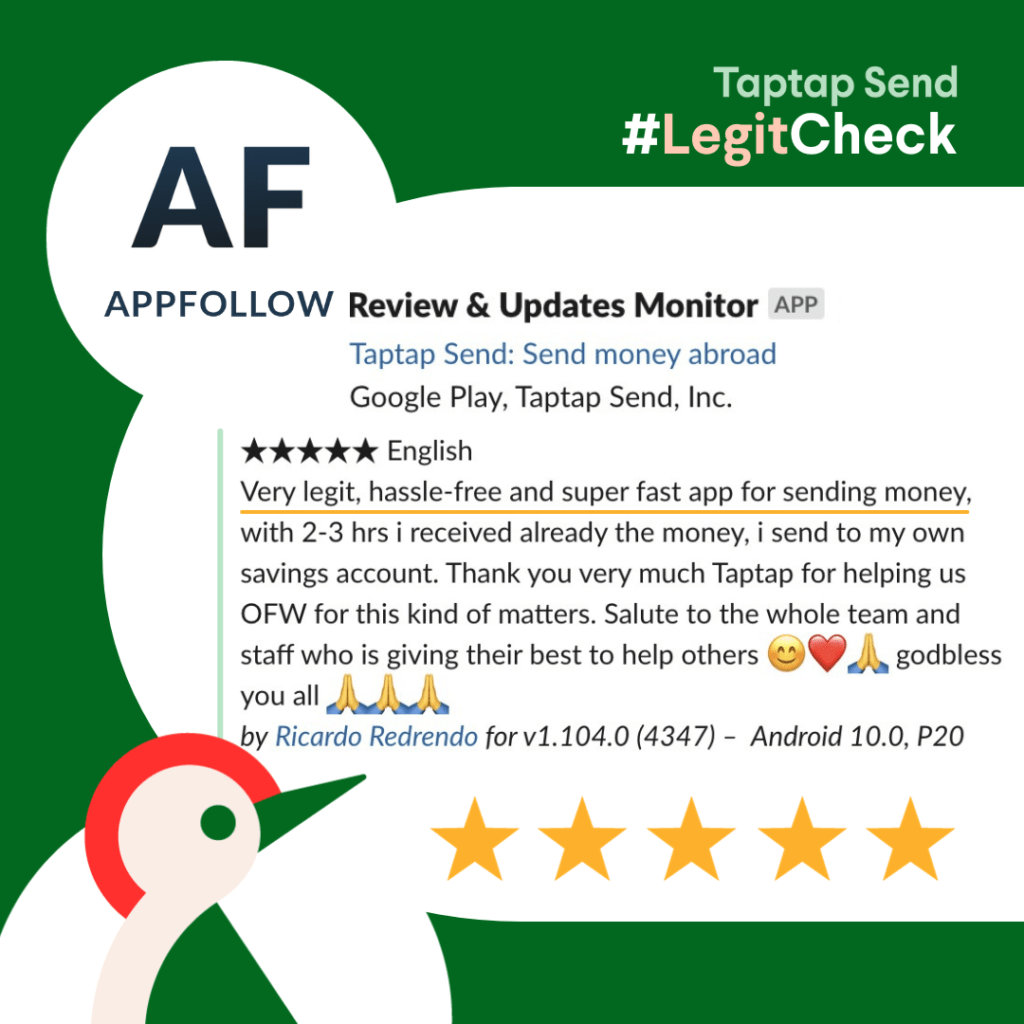

These are just a few of the many success stories that have emerged from Taptap Send’s user base. Across the globe, individuals and businesses alike have praised the platform’s ease of use, cost-effectiveness, and the transformative impact it has had on their financial lives and operations. As more people discover the power of instant remittances with Taptap Send, the platform’s reach and influence continue to grow, solidifying its position as a leader in the remittance industry.

One of the key advantages of using Taptap Send for instant remittances is the platform’s competitive pricing and fee structure. Unlike traditional remittance providers, which often charge exorbitant fees that can significantly reduce the amount of money that reaches the recipient, Taptap Send has made a concerted effort to keep its fees as low as possible, ensuring that more of the sender’s money goes directly to the intended recipient.

The fees associated with Taptap Send’s instant remittance service are transparent and clearly displayed to users upfront, so there are no hidden charges or surprises. The platform’s fee structure is based on a combination of factors, including the destination country, the payment method used, and the amount being transferred.

For example, sending money from the United States to the Philippines using a bank account as the payment method may incur a fee of just $2.99 per transaction. In contrast, sending the same amount using a debit card may result in a slightly higher fee of $3.99. Taptap Send’s pricing is designed to be competitive and fair, ensuring that users can maximize the value of their remittances.

In addition to the transaction fees, Taptap Send also offers users the benefit of competitive exchange rates. The platform’s rates are updated in real-time, ensuring that users always have access to the most current and favorable rates when sending money across borders. This means that more of the sender’s money will reach the recipient, further enhancing the value of the remittance.

Taptap Send’s commitment to transparency and cost-effectiveness is a key differentiator in the remittance industry, and it has helped to attract a growing number of users who appreciate the platform’s focus on delivering maximum value to its customers. By offering low fees and competitive exchange rates, Taptap Send is empowering individuals and businesses to send money more efficiently and cost-effectively than ever before.

In a world where the need for seamless and efficient cross-border mobile money transfers has never been more pressing, Taptap Send has emerged as a game-changer in the remittance industry. With its innovative instant remittance platform, the company is revolutionizing the way individuals and businesses send money globally, delivering a level of speed, convenience, and cost-effectiveness that was previously unattainable.

By leveraging cutting-edge financial technology, Tap tap Send has been able to streamline the remittance process, eliminating the lengthy wait times and exorbitant fees that have long plagued traditional remittance methods. The platform’s instant delivery of funds, coupled with its transparent pricing and competitive exchange rates, has empowered users to maximize the value of their remittances and ensure that more of their money reaches the intended recipient.

But Taptap Send’s impact extends far beyond the financial realm. By providing a seamless and accessible remittance solution, the platform is helping to foster greater financial inclusion and supporting economic development in communities around the world. Whether it’s a family in a developing country receiving critical financial support or a small business making timely payments to international suppliers, Taptap Send is making a tangible difference in the lives of its users.

As more individuals and businesses discover the power of instant remittances with Taptap Send, the platform’s reach and influence will continue to grow, solidifying its position as a leader in the remittance industry. With its unwavering commitment to security, transparency, and customer satisfaction, Taptap Send is poised to transform the way the world sends money, unlocking a new era of financial freedom and global connectivity.

So, if you’re looking to experience the convenience, cost-effectiveness, and peace of mind that comes with instant remittances, look no further than Taptap Send. Start your journey today and unlock the power of seamless cross-border money transfers, revolutionizing the way you manage your finances and support your loved ones or business partners around the world.