In our increasingly interconnected world, sending money across borders has become essential for many. The Philippines, home to a widespread diaspora, is a significant receiver of remittances, with these financial supports bolstering families and contributing to the country’s economy. However, high fees and complex processes often challenge those wishing to send money. TapTap Send emerges as a leading solution, and when combined with GCash, it streamlines the process of supporting your loved ones back home.

For the Philippine economy and countless families, remittances are more than just financial transactions; they’re lifelines that fund education, healthcare, and daily living expenses.

The traditional route of sending money to the Philippines and internationally is fraught with high fees, poor exchange rates, and delays, making the process costly and sometimes unreliable.

TapTap Send is a revolutionary app designed for quick, affordable, and secure money transfers. It stands out for its user-friendly interface and its commitment to low transaction fees and competitive exchange rates.

ZERO-Fees and Great Rates: TapTap Send’s minimal fees and favorable exchange rates ensure more money reaches your loved ones.

Speed and Security: Transfers are not only fast but also secure, giving you peace of mind.

GCash Integration: By transferring directly to a GCash wallet, recipients can easily access funds, pay bills, shop online, or withdraw cash from over 20,000 ATMs nationwide without a card.

TapTap Send prioritizes your security with top-notch encryption. Should you need help, customer support is readily available.

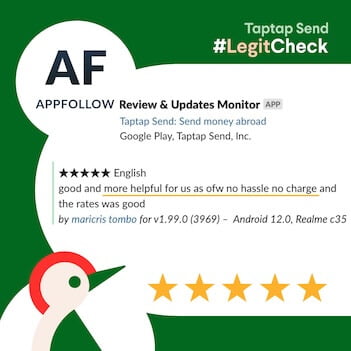

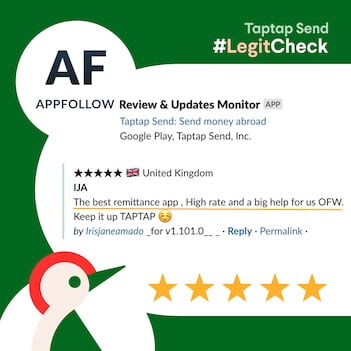

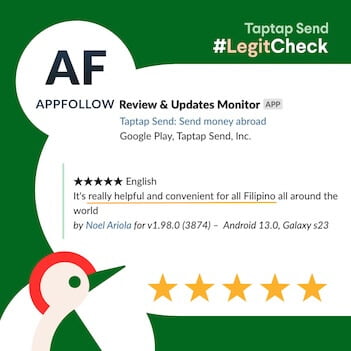

Users like Maria appreciate the synergy between TapTap Send and GCash for its convenience and efficiency. “It’s revolutionized how I support my family. They receive money in seconds and can use it immediately, whether for emergencies or daily needs.”

When weighed against other services, the combination of TapTap Send’s ZERO-Fees and GCash’s wide-ranging functionality in the Philippines offers unmatched value and convenience.

Sending money to the Philippines has never been easier or more economical than with TapTap Send and GCash. This partnership ensures that your support reaches your loved ones swiftly, securely, and with more value. Embrace the future of international remittances today for a hassle-free experience that keeps you connected to those who matter most.

Download TapTap Send, connect it with GCash, and experience a seamless transaction process. Visit the TapTap Send website for more details and to begin your journey of easy, effective remittances.